Blockchain is revolutionizing everything! Whether it is a payment transaction or raising money in the private market. Traditional banking has two choices: either embrace this technology or fade into oblivion.

Let's look into the reasons why blockchain has the potential to disrupt the traditional banking system.

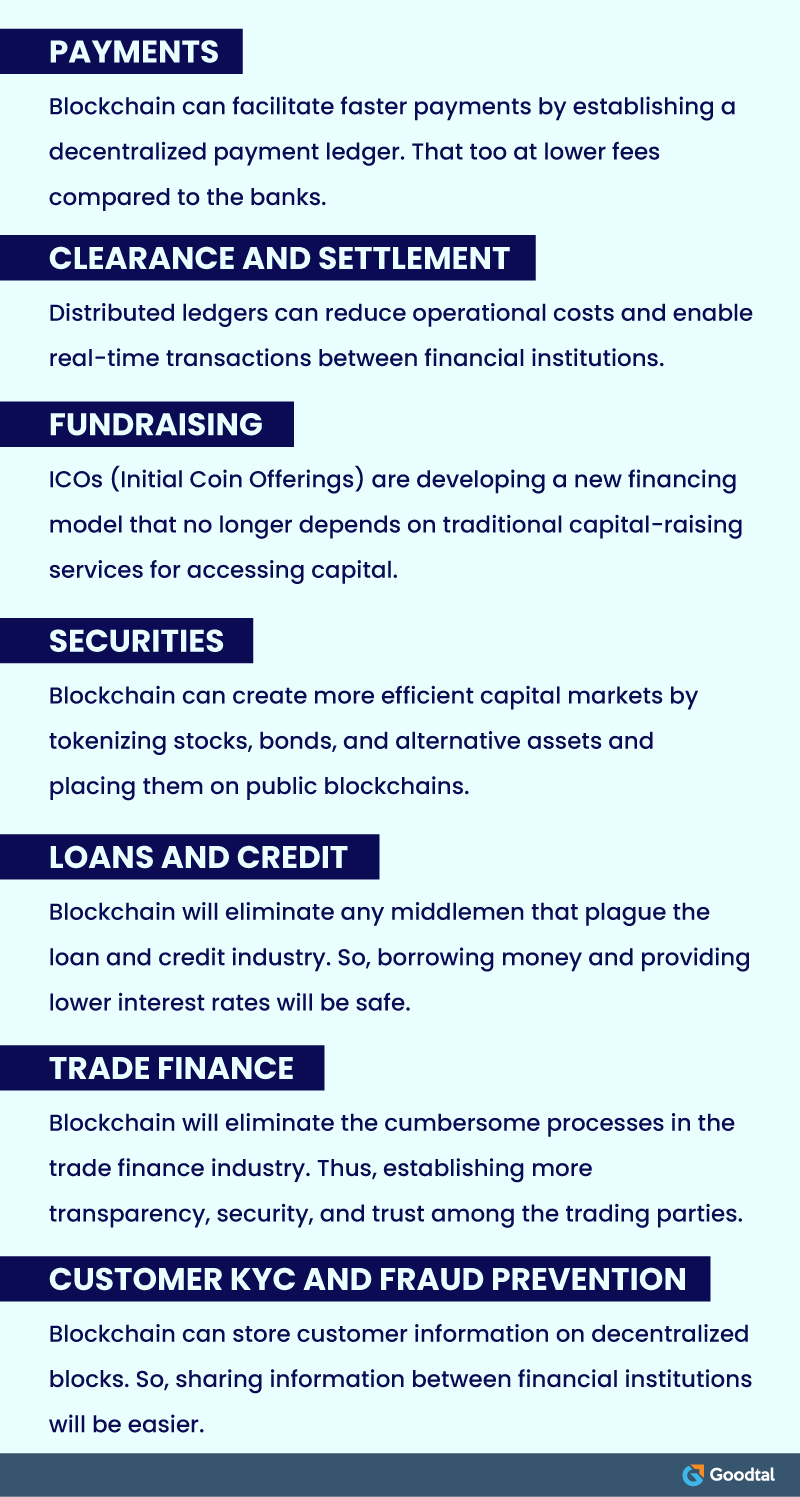

Here Is How the Blockchain Can Transform the Banking Industry

Blockchain technology allows two parties to forge an agreement without the need for having a middleman. It provides a decentralized ledger for financial services, like payments or securitization, thereby eliminating the need to visit a bank.

Further, the tools like smart contracts can automate manual processes like compliance and claims processing, or the content distribution from a will.

Blockchain's distributed ledger technology can help establish better standards around data sharing and collaboration. It can massively shake the $7T+ banking industry by eliminating banks' essential services. Here are some examples:

Let's go in-depth regarding how blockchain can impact different aspects of traditional banking.

For Further Reading: Remarkable Ways AI and Blockchain Are Transforming the Future

Payments

Traditional banking has become an antiquated system of added fees and slow payments.

You might have to pay a flat fee for a wire transfer and additional fees if you work in New York and want to send a part of your paycheck back to your family in France.

Your bank will get a cut, the receiving one will get one too, and you will be charged exchange rate fees. Your family's bank might even register the transaction a week later.

The cross-border transactions in B2B and C2B generated $175B in payments revenues in 2020. It's profitable for banks to facilitate payments. So, they have little incentive to lower the fees.

Cryptocurrencies like ether and bitcoin are built on public blockchains. So, anyone can use them to send and receive money. Public blockchain eliminates the need to involve third parties in verifying transactions. It will give people access to fast, cheap, and borderless payments worldwide.

Currently, bitcoin transactions take 25 minutes on average to settle. It still needs improvement but is much better than bank transfers' average three-day processing time.

Governments and regulatory bodies won't be able to control, observe, and shut down the entire process as crypto-based transactions are decentralized and complex.

Developers are working on creating cheaper solutions to process crypto transactions more quickly.

Customer KYC and Fraud Prevention

KYC (know your customer) is the process of onboarding customers, verifying their identities, and ensuring that all their information is in order.

Banks can take up to 3 months to complete all KYC processes, including verification of photo IDs, address proofs, and biometrics. A delay in the KYC process may cause some customers to switch to another bank. Approx 12% of businesses said that they had switched their bank due to delays in the KYC process.

Complying with KYC rules is also costly for banks. They spend up to $500M annually on these processes. Blockchain technology can reduce the cost and human effort involved in KYC compliance.

With KYC customer data stored on a blockchain, the decentralized platform would enable all institutions that require KYC to access the information. Goldman Sachs revealed that banks could save approx $160M annually by using blockchain for KYC.

Blockchain technology can also help banks in preventing fraud and detecting cyberattacks. Storing all customer information in one place makes it vulnerable to an attack.

With decentralized storage, blockchain technology can prevent a hacker from gaining access to the customer's data. Smart contracts can help establish secure transactions. These contracts operate on an "if/then" condition, where the next step won't ensue if the prior one hasn't been completed. It will allow the establishment of more fail-safes in the digital transaction process.

For Further Reading: How Blockchain Can Transform the Insurance Industry

Easy Loans and Credits

Blockchain technology allows for P2P (peer-to-peer) loans, complex programmed loans that can estimate a mortgage or syndicated loan structure. It can provide a quicker and more secure loan process in general.

When a person applies for a bank loan, the bank evaluates the risk of whether they can pay them back or not. It looks at credit score, debt-to-income ratio, and home ownership status.

To get the above information, the bank needs to access a person's credit report provided by the credit agencies like Experian, TransUnion, and Equifax. Concentrating all the data within these three institutions creates a lot of susceptibilities.

Based on that, it will price the risk of default into the fees and interest to be collected on loans.

This centralized system is hostile to consumers. Nearly 1 in 3 Americans has a subpar credit rating, a significant obstacle to getting loans at affordable interest rates.

Alternative technology like blockchain offers a cheaper, more efficient, and secure way of providing personal loans to a broader pool of customers. A cryptographically decentralized registry of historical payments will enable consumers to get required loans based on a global credit score.

For Further Reading

Check out GoodFirms' research on Mobile Banking Apps. It shares excellent insights on technologies that will revolutionize mobile banking apps. It also shares data and surveys on why customers prefer private banks, why they choose mobile banking over net banking, and the challenges in mobile banking apps.