Social media scams pose a severe challenge for businesses, customers, governments, and platform providers.

These cyber-criminals prey on unsuspecting targets by hiding behind the anonymity of fake accounts and profiles. Nowadays, scamming has become more structured, better organized, and targeted.

The infamous prince of Nigeria emails are falling out of fashion as scammers are becoming more sophisticated to the point that even cyber security experts are taken aback.

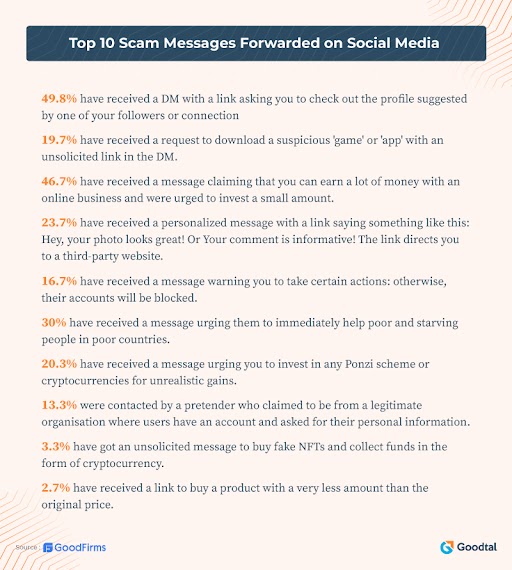

So, we have compiled a list of the top 5 social media scams that you should always remain alert to on the internet. First, let me share some statistics that show how dangerous these scams have become.

Eye Opening Social Media Scamming Statistics

Social media fraud has been on the rise over the past four years. We often go blinds eye to it. Here are some alarming stats regarding online scams as per Federal Trade Commission Report:

- Ninety-five thousand people, which is more than twice the number in 2020, reported losing money due to social media fraud in 2021.

- In 2021, there was a loss of $770 million due to social media scams, representing 26% of all fraud losses reported last year.

- 70% of social media fraud comes from the investment, romance, and online shopping scams in 2021.

- The Federal Trade Commission revealed that only 4.8% of fraud victims report losses.

The Top Social Media Scams To Watch Out For

Here are the top 5 social media scams to watch out for:

Data Breaches

A data breach is when cyber criminals hack into a company's computer systems and steal their customer's data. Nobody is immune to it. For example, Facebook suffered a data breach that leaked the personal information of more than 500 million users. The same incident occurred with LinkedIn, which exposed the data of 700 million people.

Cybercriminals hack into social media sites to steal users' personal information. They can use it to access your online credit card or bank accounts. Even take loans or issue credit cards in your name.

Data breaches are beyond your control. Social media companies like Facebook, Twitter, and Instagram are responsible for protecting your data.

But here is what you can do for the sake of prevention, scan your online bank and credit card accounts regularly for suspicious transactions. Use a credit-monitoring service as they will alert you to the changes in your bank accounts. It will allow you to quickly alert banks and financial institutions on any fraudulent activities before it inflicts too much damage.

Social Media Scraping

Oversharing on social media can expose you to cybercriminals.

Scammers scour social media sites for personal information. People often share their birthdates, names, marital status, headshots, and location, which fraudsters can easily exploit. They can use this data to gain access to people's financial accounts.

Avoid posting too much personal information on social media sites as possible.

People would often share their vaccine cards on social media after getting their COVID-19 shots. It contains essential information hackers can use to steal a person's identity.

So, be vague when posting on social media. Don't give cybercriminals too much information through your post.

Giveaway or Contest Scams

We often witness posts advertising a lottery or giveaway on social media.

"Like a post or comment on it and get a chance to win a free gift card, a month's worth of free food delivery, or $500 worth of free clothes from a favorite retailer."

Sounds similar and too good to be true, right? These social media giveaways are often a scam, unfortunately. People behind these have no intention of giving away any prizes. They are farming social media likes from people. Here is an example:

(Source: Cnet)

The masterminds behind these want to collect enough likes and shares to make their posts viral on social media. Once they have earned enough, they will edit the social media post with a link to malware that will automatically download onto the devices of those who click on it.

Seeing so many likes on the post, some people may believe it's true and end up falling for the scam.

Scammers often edit their post's original content once they have enough likes to get higher views and replace it with ads for illegal products.

So, please be careful when liking or commenting on social media posts advertising lotteries or prizes. To ensure it's legit, peek into terms and conditions. The legitimate ones include:

- The contact information of the organizers.

- Requirements for participating in it.

- A list of rules that participants must follow.

It's a big red flag if you can't find any such information. Also, giveaways asking you to complete too many tasks like commenting on several posts and liking multiple ones are trying to farm social media likes from you. So, avoid these at all costs.

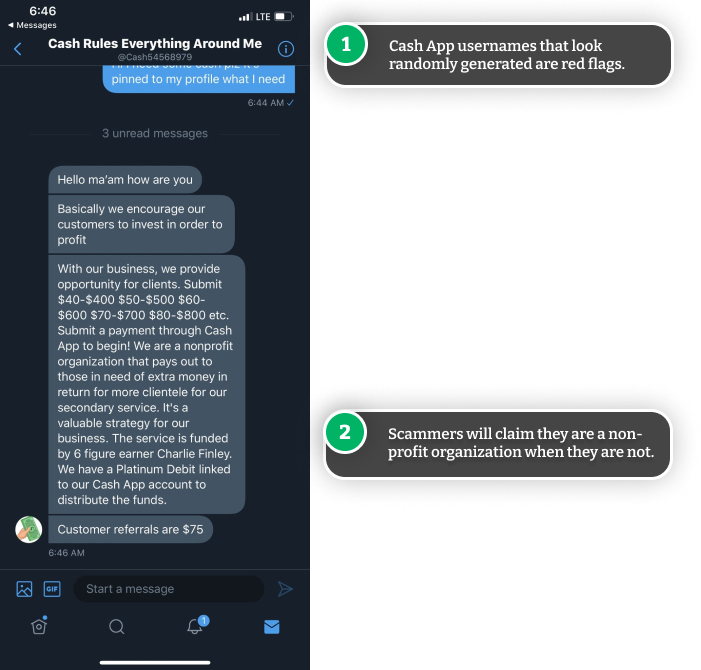

Card Popping

Fraudsters often run ads on social media sites and contact people directly through them. These scammers try to tempt people with a chance to make quick money by allowing them first to deposit checks into an individual's bank account.

(Source: 3Rivers)

These checks are often stolen from mailboxes and other sources. Many times, there are no checks. Cyber-criminals will promise a victim a share of the money after depositing checks into their accounts. Once the victim has provided their bank account information, these scammers will steal the funds from it and disappear.

Sometimes, depositing stolen checks in the victim's account can make them unwitting co-conspirators in fraud.

So, never trust anyone who comes up with a proposal on how to make money fast. Also, never share your bank account information with online strangers. That's a sure sign of a scam.

Money Flipping

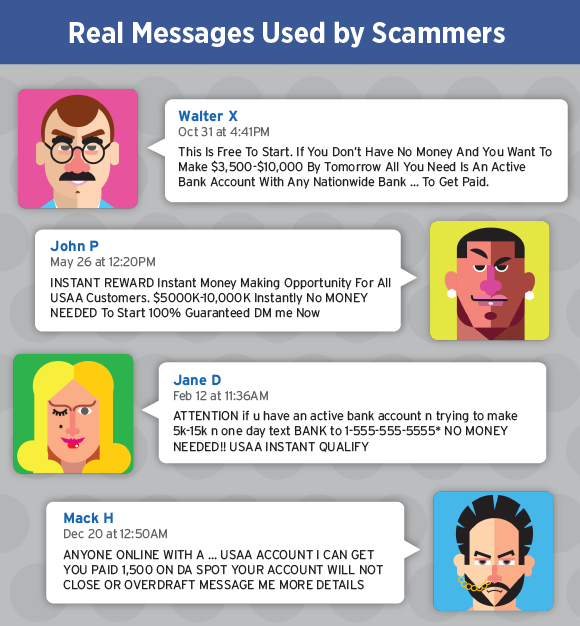

Con artists know that people are easy to lure through get-rich-quick offers, making money-flipping scams popular on social media.

Here the scammer will make a post on Instagram, Facebook, Twitter, or other social media sites, usually with a photo of cash, and tell people they can make a quick buck with minimum effort. Users can contact the poster to find out the entire process. Here is an example:

(Source: Verified.org)

If a user does reach out, they will be asked to fill a prepaid debit card with money and share the card number and PIN with the scammer. The fraudster promises to flip the initial investment into a much larger payday.

Once the person provides this information, the con artists will proceed to drain the card of its funds and disappear. The victim has now lost the amount they deposited onto their debit cards.

Legal investment services never ask you to deposit money on a prepaid debit card. Also, they will never ask for your card's number and Pin. So, if someone asks for it, immediately cease all communications as that's most likely a scam.

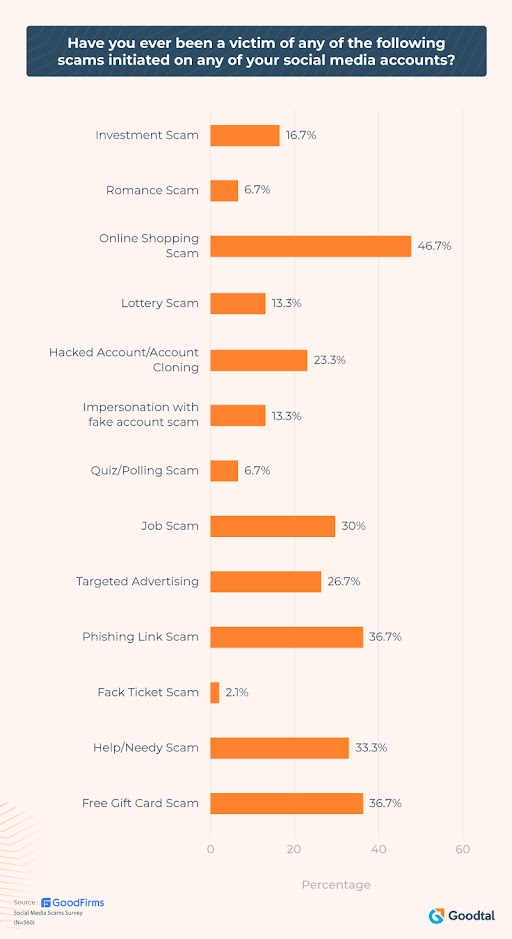

Who Gets Scammed The Most?

Fraud prevention firm SEON analyzed data collected in 2020 by the FBI's Internet Crime Complaint Center. As per their report, younger people are more and more becoming victims of online scams, but older generations lose the most money.

There is a significant increase in fraud reports from people younger than 20 between 2019 and 2020. Approx 23,186 young people who have been victims of fraud represented a 116% increase compared to the previous year. Their collective losses total about $70.98 million, or about $3000 per person, in 2020.

People in their 20s saw a 59% increase in fraud reports between 2019 and 2020. Approx 70,791 reported victims lost an average of $2,789 each.

The oldest Americans have lost the most to online scams. Around 105,000 individuals 60 and older reported a combined loss of $966 million. That's $9,100 per person. Those in their 50s had the highest losses, with an average of $9,864 each. Those in their 30s lost approx $5,570 each in 2020, while the ones in their 40s lost $7,832.

For Further Reading

Check out GoodFirms in-depth research on social media scams. It has covered other significant variants of online scams, how fraudsters exploit the inherent human traits, and tips for protecting yourself from such cons.